The recent story of Kent Brushes, a company established in 1777 and supplying the British Royal Family and victim of a £1.6m fraud that took less than 30 minutes, underscores the need to understand why fraud occurs and ultimately prevent it.

The Fraud Triangle is an established framework for understanding the elements influencing fraudulent behaviour ranging from Accounting Fraud to theft (Cressey, 1953). This model, created by Donald Cressey in the 1950s, proposes that three essential components- pressure, opportunity, and rationalisation – combine to drive people to commit fraud. The Fraud Triangle has limits even though it has significantly impacted criminology and fraud detection. We shall investigate, assess, and suggest alternatives to the Fraud Triangle.

An Overview of the Fraud Triangle

1. Pressure: Financial, personal, or professional hardships can put someone under immense pressure and make them think about engaging in fraud. Typical stressors encompass debt, addiction, or the need to maintain a specific way of life. Consequently, these pressures provide the incentive for deception or fraud.

2. Opportunity: This refers to the circumstances that allow someone to perpetrate fraud without being discovered. This could result from weak security protocols, insufficient supervision, or poor internal controls in a company. Opportunity plays a crucial role in the Fraud Triangle model since it establishes the likelihood that fraud will be committed.

3. Rationalisation: This is the mental process by which a person convinces themselves that their dishonest activity is acceptable. It is how the individual persuades themselves that, in the situation, what they are doing is appropriate or even necessary. The Fraud Triangle highlights that rationalisation is essential and the final ingredient to facilitating fraud.

The constituents of the Fraud Triangle, see below, are analogous to kindling a fire; thus, pressure is the oxygen, opportunity is fuel, and rationalisation is the heat, and all three are essential for the execution of a fraud.

Source: Fraud 101: What is Fraud? (acfe.com)

Analysing the Fraud Triangle

The Fraud Triangle remains influential, but it is not without drawbacks. We will endeavour to examine its drawbacks and suggest some alternatives.

1. Excessive simplification: The intricate psychological and environmental elements that lead to fraud are oversimplified if not ignored by the Fraud Triangle. Many more variables affect human behaviour than simply pressure, opportunity and rationalisation. For example, individual values, social influences, and psychological characteristics are not sufficiently addressed.

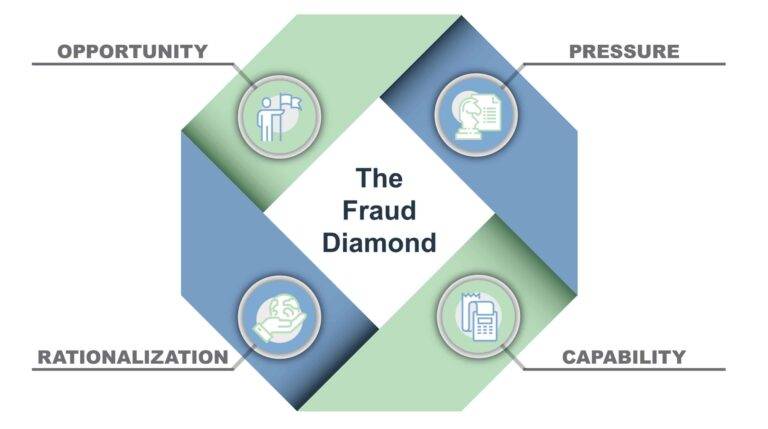

Alternative: A more thorough model, such as the Fraud Diamond (Wolfe & Hermanson, 2004), introduces a fourth dimension, namely capability, see below, that takes into consideration a person’s capacity to justify and execute the fraud. This recognises that cognitive dissonance, a key factor in rationalisation, is not exclusively influenced by external pressures.

Source: Fraud Diamond Model | Four Elements Fraud | Atlanta CPA Firm (windhambrannon.com)

2. Lack of Preventative Focus: Rather than emphasising ways to stop fraud, the Fraud Triangle primarily focuses on understanding why it happens. Focusing on the three factors that drive fraud fails to offer organisations practical advice on safeguarding themselves properly.

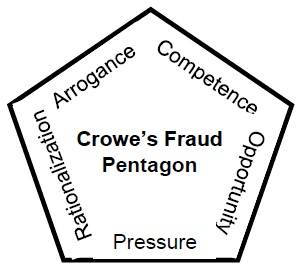

Alternative: The Crowe’s Fraud Pentagon (Howarth, 2011) takes a more proactive approach by including arrogance, see below, as the fifth component of pressure, opportunity, rationalisation, competence, or capability. Arrogance makes individuals feel that the usual ‘rules in the company’ do not apply to them. Hence, if a strong anti-fraud culture is created, implementing robust controls and conducting thorough background checks, identifying and containing a fraudster should be possible.

Source: Fraud Pentagon Theory | Download Scientific Diagram (researchgate.net)

3. Individual-Centric: The Fraud Triangle focuses on the individual’s psychology and decision-making. It assumes that a person’s actions are merely driven by personal financial gain, often ignoring situational or systemic pressures and influences.

Alternative: The Organizational Fraud Triangle Leadership (Free et al., 2007), see below, provides a more comprehensive approach by reorienting the emphasis from individual traits to organisational circumstances. It suggests that an organisation’s qualities, like its culture, ethics, and control environment, interact with the characteristics of an individual to produce fraud.

4. Linear Model: The Fraud Triangle implies a linear progression, with pressure leading to opportunity, leading to rationalisation. This linearity oversimplifies the complexity of real-world fraud scenarios, where these elements may interact in various combinations.

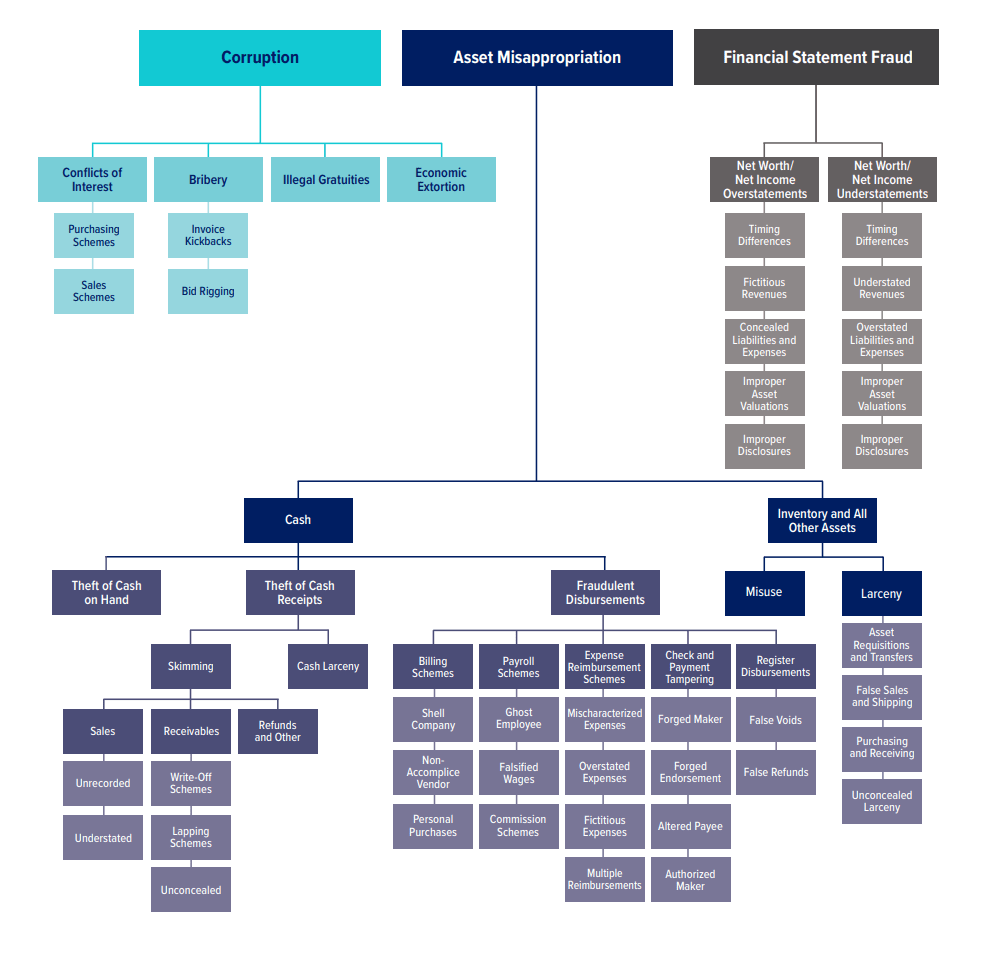

Alternative: The Fraud Tree Model (ACFE, 2016) extends the Fraud Triangle and acknowledges that there are complex and multiple pathways, see below, that might lead to fraud. It acknowledges that people can enter the fraud cycle at any point, depending on their circumstances.

Source: Fraud 101: What is Fraud? (acfe.com)

5. Excludes External Factors: The Fraud Triangle ignores outside influences that might have a big impact on the incidence of fraud, such as industry trends, legal requirements, and economic situations. These elements may combine to provide a conducive environment for fraud to flourish.

Alternative: To provide a more nuanced and thorough picture of the fraud landscape, a holistic and ‘people-centric’ perspective would suffice and be at the heart of a robust anti-fraud risk assessment methodology. (The authors will introduce the SM CROWE ANTI-FRAUD BUILDER (Sheikh & Maniar, 2023) in their next joint article.

In summary

Despite being a fundamental model for comprehending fraud, the Fraud Triangle has many drawbacks. It focuses primarily on personal motives, oversimplifies the complicated nature of fraudulent behaviour, and provides little advice on prevention. More sophisticated models for comprehending and combating fraud exist, such as the Fraud Diamond, Fraud Pentagon, Organizational Fraud Triangle, Fraud Tree, and the SM CROWE Anti-Fraud Builder. In the end, the authors contend that strong organisational cultures and controls that discourage fraudulent behaviour and efficiently manage risk should be the primary emphasis of fraud prevention rather than just concentrating on the motivations of specific individuals.

References

ACFE. (2016). The Fraud Tree. Accessed 22 October 2023. https://www.acfe.com/fraud-resources/fraud-risk-tools—coso/-/media/51FB0E7892E24FC392ED325FE0A42C2A.ashx

Cressey, D.R. (1953). Other people’s money; a study in the social psychology of Embezzlement. New York: Free Press.

Free, C., Macintosh, N. and Stein, M., 2007. Management controls: The organisational fraud triangle of leadership, culture, and control in Enron. Ivey Business Journal, 71(6), pp.1-5.

Horwath, C. 2011. Accounting Standard Update. Available at http://crowehowardth.net/id/

Sheikh, F.M.2023. Forthcoming PhD. Thesis. University of Salford.

Wolfe, D.T. & Hermanson, D.R. 2004. The Fraud Diamond: Considering the Four Elements of Fraud. CPA Journal 74(12): 38-42.