Understanding Metro Bank’s trap

Let me clarify that “Metro did not fail” but got caught in the trap of its ambitions. Metro Bank started as a challenger to reinvent the British Banking landscape by becoming a “bank next door”. The idea is simple but is far from the ex-post-financial crisis realities and ignores the emergence of fintech. In the time when established banks were striving to cut costs, lower the provision of bad debts, and were trying to gain operational efficiency through technology to avoid failing, Metro Bank took the opposite direction, which is as follows:

- It developed a highly expensive branch system.

- It relied on interest income generated through the spread between deposit plus borrowing costs and interest income from lending.

- It used high-quality bonds as safety assets deposited with the Bank of England.

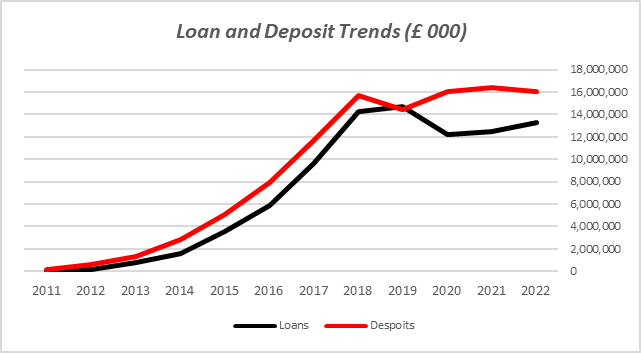

One may wonder what is wrong with these steps. There is no simple answer but a set of trends that one must follow to see what has happened. Metro Bank is a deposit-intensive bank, and from the start, it aimed to leverage the depositor’s money to finance their income-generating assets. Current and low-interest-rate savings accounts did a fantastic job financing Metro’s plan. As shown below, the bank’s loan and deposit books closely followed each other. Therefore, Metro, from the very start, tried to lend as much as it could using its customers’ deposits.

Metro Bank – Impact of Covid

The strategy worked until 2019, when it became apparent that the bank was poorly prepared to handle systemic shocks such as Covid. It’s also noticeable that Metro was always a capital-deficient bank that believed its “borrowers will pay on time and in full”. Banking does not operate this way; banks must have surplus capital to account for bad debt, defaults, and systemic shocks.

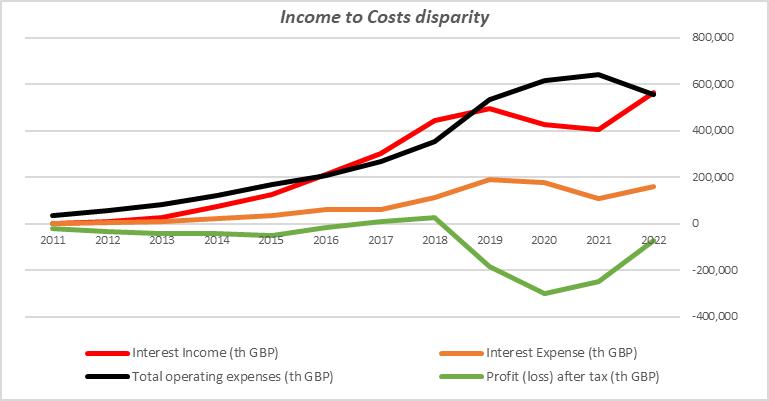

Being an ambitious bank is fine, but whether this strategy generates enough net interest income to cover interest and operating expenses is challenging. Metro could cover its interest expenses, but its overreliance on branch banking made it operationally inefficient and a loss-making entity. Apart from 2016 to 2019, the bank never covered its operational costs plus interest expenses through its interest income. Since 2018 bank has been making significant losses.

Metro Bank’s Economic Climate

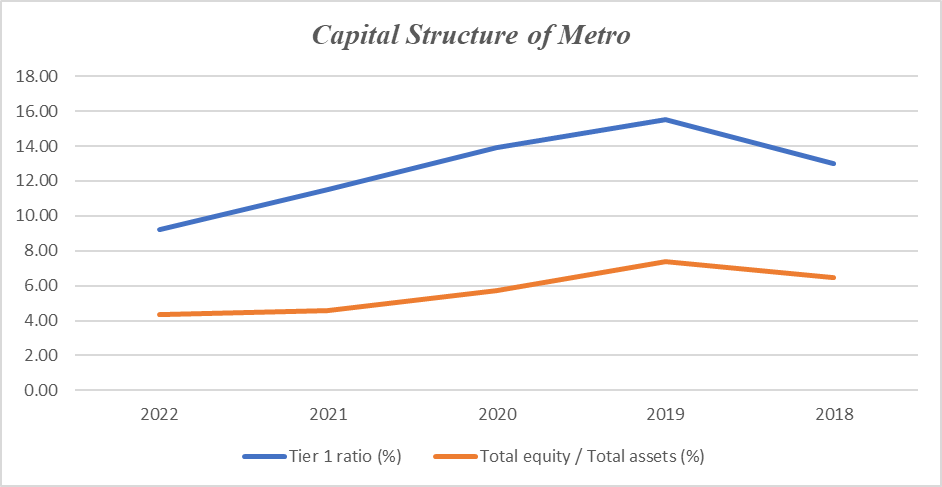

In addition to poor strategic orientations, Metro is also a victim of recent economic calamities. Rising interest rates have lowered the values of its safer assets, such as bonds. These bonds are deposited with the Bank of England to cover its capital charge requirements. However, due to the decreased value of bonds, Metro must top up its capital reserve to remain aligned with the Bank of England’s regulatory requirements. Other than in 2018 and 2019, Metro’s tier 1 capital never touched 13% and has been capital deficient ever since.

Therefore, a bank whose assets are losing value, customers whose savings are decreasing, and borrowers whose ability to pay is becoming questionable due to a cost-of-living crisis are bound to face a blood bath. As Sir John Maynard Keynes said, when facts change, change your mind, or for Metro, change your ambitions.

References

- Mishkin, F. S., & Eakins, S. G. (2019). Financial markets. Pearson Italia.

- Madura, J. (2020). Financial markets & institutions. Cengage learning.

- Pilbeam, K. (2023). International finance. Bloomsbury Publishing.

- Fabozzi, F. J., Modigliani, F., & Jones, F. J. (2010). Foundations of financial markets and institutions. Pearson/Addison-Wesley.

- Kaufman, H. (1994). Structural changes in the financial markets: economic and policy significance. Economic Review-Federal Reserve Bank of Kansas City, 79, 5-5.

- Kaufman, H. (2009). The road to financial reformation: Warnings, consequences, reforms. John Wiley & Sons.

- Kaufman, H. (2017). Tectonic Shifts in Financial Markets: People, Policies, and Institutions. Springer.

- Hunter, W. C., Kaufman, G. G., & Krueger, T. H. (Eds.). (2012). The Asian financial crisis: origins, implications, and solutions. Springer Science & Business Media.

- Glushchenko, M., Hodasevich, N., & Kaufman, N. (2019). Innovative financial technologies as a factor of competitiveness in the banking. In SHS Web of Conferences (Vol. 69, p. 00043). EDP Sciences.

- Kaufman, G. G. (2002). Too big to fail in banking: What remains?. Quarterly Review of Economics & Finance, 42(3), 423-423.

- Kaufman, G. G. (2000). Banking and currency crises and systemic risk: Lessons from recent events. Economic Perspectives, 24(3), 9-28.

- Diamond, D. W., Kashyap, A. K., & Rajan, R. G. (2017). Banking and the evolving objectives of bank regulation. Journal of Political Economy, 125(6), 1812-1825.