As the dust settles, Friday, 17th November, will become a watershed moment in the burgeoning AI industry. Two of the principal architects and public faces of Open AI – Sam Altman and his buddying face Greg Brockman– lost the confidence of their board. When Altman joined OpenAI in 2019, it was a dream project aiming to change human civilisation forever. So, despite being so successful, what went wrong?

Similar Tragedies in Corporate American History

In 1983, Jobs famously asked Sculley, “Do you want to spend the rest of your life selling sugared water, or do you want a chance to change the world?” when he hired him as Apple’s CEO from PepsiCo. However, the differences between Jobs and Sculley grew as Apple fought to stay afloat and compete in the quickly changing personal computer market.

The direction of Apple’s product strategy was one of the main points of dispute. With his expertise in marketing, Sculley concentrated on more traditional commercial techniques, whereas Jobs was renowned for his innovative ideas and insistence on developing ground-breaking goods. Internal tensions and disagreements over handling the organisation’s issues resulted from this clash of visions.

Looking at Job’s removal, one may argue that he was fired to save Apple from his autocratic management style and due to his differences with the then CEO, John Sculley. However, Apple was facing financial challenges, and there were disagreements about the direction of Apple and its product strategy. On the other side, Altman’s OPEN AI is the talk of the town; the world is watching it with surprise and awe, and politicians are trying to comprehend its implications.

Sam Altman and Open AI Board

We argue that Altman’s dismissal is reminiscent of Steve Jobs’s 1985 firing from Apple. Although we have no insider information, we speculate it’s hard for alpha personalities such as Altman to co-exist with cold, calculating, and risk-averse minds. For board members and investors, pay-back periods, cost-benefit estimates and creative accounting are more important than the dream projects.

Reports note that Sam needed to be more candid in his communications with the board, which led to losing the board’s confidence. Nevertheless, we must consider the potential personal rivalries in the boardroom and a complete communication breakdown between Altman, Brockman, and the board.

Improving the relations between Tech Innovators, Industry, and Stakeholders

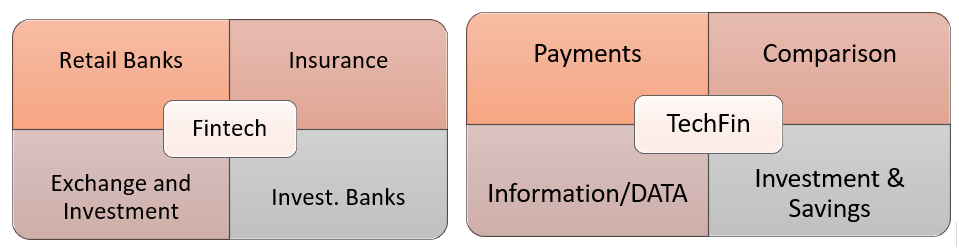

Like any other industry, the tech and AI sector is always in perpetual flux, which means everything and everyone has to be agile. Such forced agility requires a constant compromise between giant egos, cold calculations, and societal intransigence. The tech sector is a pivot of dynamic and diversified contemporary growth, with a wide spectrum of businesses with various cultures and practices. However, to maximise its impact, it must improve its workplace culture, diversity and inclusion and accept the realities.

Challenges of the Tech Industry

Below, we identify the challenges to realising the benefits of the tech industry and propose solutions for these challenges.

Workplace Culture:

1. Stress and Burnout: Due to the fast-paced nature of the tech sector, employees may experience significant levels of stress and burnout.

2. Intense Competition: A culture where achievements are valued more highly than well-being may be fostered by a competitive atmosphere, which could result in ruthless competition.

Solutions:

A. Stress Work-Life Balance: Organizations can support a good work-life balance by encouraging appropriate work schedules and discouraging long hours.

B. Create Supportive Environments: Stress can be decreased, and a pleasant environment can be fostered by establishing a work culture that values cooperation, communication, and mutual support.

Considerations for Ethics:

1. Privacy Concerns: When tech corporations gather and utilize personal data, privacy concerns may arise.

2. Ethical Use of AI: If AI systems are developed and implemented without sufficient ethical thought, unfavourable outcomes may result.

Solutions:

A. Transparent Policies: To ensure customers know how their data is handled, companies can set up transparent policies surrounding data usage and AI deployment.

B. Ethics Training: Providing ethics instruction to staff members working on AI development can aid in bringing up possible ethical issues.

Effect on Society:

1. Job displacement: Certain professions may lose their jobs because of automation brought about by AI and technology.

2. Algorithmic Bias: If AI systems are not properly built and evaluated, they may reinforce and even magnify societal biases.

Solutions:

A. Investing in Reskilling: Businesses might fund initiatives that assist staff members in gaining new skills to adjust/pivot to changing job demands.

B. Ethical AI Development: Negative societal effects can be minimized by giving ethical issues, such as reducing bias and maintaining openness, the foremost priority in AI development.

Cooperation and Control:

1. Lack of Collaboration: Innovation and advancement can be impeded by company rivalry and a lack of cooperation.

2. Inadequate Regulation: When regulations are insufficient, it can lead to unethical behaviour or improper use of technology.

Solutions:

A. Industry Collaboration: Promoting industry collaboration among businesses can result in group initiatives to solve shared problems and promote innovation.

B. Regulatory Frameworks: Encouraging the creation of thorough and moral regulatory frameworks can offer standards for ethical behaviour.

Authors’ Recipe for Change

Way Forward

In conclusion, even though the IT and AI sectors have greatly benefited society, resolving perceived toxicity requires a diversified strategy. However, to realise their full potential, we must build an environment that promotes innovation and societal well-being. Collaboration between industry executives, policymakers, and employees is imperative to develop a tech landscape that is not just technologically advanced but also ethical, inclusive, and mindful of its influence on society.

As for Altman and Brockman (AB), they will emerge wiser and stronger from the crisis. AB 2.0 may prove to be a blessing in disguise, as there will be further competition in the AI industry, which will ultimately benefit humanity at large.