Banks are important in any modern economic system. As a structuralists one may regard banks as a central organ of our society such as heart valves that pumps clean blood into our arteries. Their omnipotence also stems from their ability to collect and store customers’ financial data. Banks can also leverage this data to become verifiers of our identities such proof of address, proof of income, proof of cash balance, and proof of identity. Therefore, computing becomes central to modern banking and tech companies and innovators now fancy that lets just take over the entire banking function in the name of “Fintech”. One wonders that can BigTech and tech innovators actually replace or make banks disappear (just like coal mines or steel mills in the UK). Let’s look the challenge of Fintech.

Fintech or Techfin

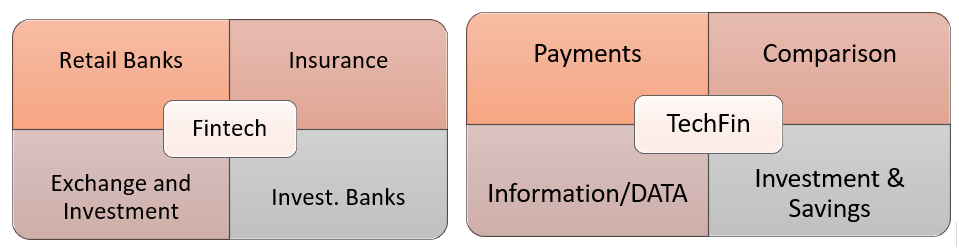

The first challenge is to define fintech, the clue is in the name. Firms that were traditionally engaged in deposit taking, payments, lending, insurance, or brokerage businesses and now they use technology to perform similar operation may be labelled as Fintech []. Firms that are traditionally in the IT business such as Apple, Google, Samsung, Amazon, or other BigTech when they try to provide traditional services using their technologies to their customers ma be defined as “TechFin”. This dichotomy is confused that everything even a website offering advice on buying bitcoin now have started to call itself a FinTech. It’s the latter that is challenging the former in some aspects of their operations not the other way around. Because the entities being challenged are so big and mesmerising in their functions, it’s fashionable to allude every startup as a FinTech.

Whereas some startups are nothing more than an advisory website offering purchase suggestions or make investors opinion. Other startups are mere tech native firms who try to leverage their IT capabilities and provide one or two financial services such as Klarna (buy now pay later).

Fintech an emergent challenge to banks

Alchemy of Banks: We need to understand their “Raw Material”, “Inventory”, and “merchandise”, which banks use to create or manufacture their products and services. Banks use money that they create using customers “Depositors” and “lend or invest” to other people, firms, and governments. In another thread, I’ll explain that banks can neither take deposits nor make loan or investments, it’s against the law. Therefore, banks’ products are of four types:

1. Conventional Banking:

These are the activities that involve usage of banks’ balance sheet (money) such as underwriting, insurance, and portfolio management. These products rely on a bank’s balance sheet as banks would have to honour their commitment and pay if a counter party to any agreement defaults. Imagine, you take a long-forward position in a currency swap agreement and bank arranges the swap between you another counter party. When the times comes, and the counter party now struggles to provide you the currency, in this case, the bank takes the responsibility and settles the exchange.

Similarly, if you’re a company and has just announced an IPO of 1 million units @ $50 each stock and bank has agreed to underwrite it if the full stock is not sold and the price falls below $30. On day of launch, if the market price is $30 but only half million-stock sell, then the bank will buy the remaining stock at $30 from you. These types of activities require deep balance sheets and ability to absorb large losses.

2. Platform Banking:

These are the activities that involve usage of banks resources and expertise such as advisory, transfer of money, conversion of currency, and price comparison. These services are mere advisory services and require nothing but an escrow account to settle payments and in some cases, they need not have an escrow account even. Firms such as marketer, INSHUR, Experian, Credit Karma, Wise, and Revolut has escrow account at large banks and they provide services as money exchange, currency conversion, money transfer, trading, or even insurance offers. But they don’t hold your deposit or lend you any money, they are just intermediary. Other services providers such as Credit Karma use data provided by banks to market financial and insurance products. They do not offer anything but information and platform.

3. Infrastructure Baking:

These are the activities where banks leverage their physical, IT and non-physical infrastructure to serve the needs of society such as merchant payments, online payments, secure set-up of direct debits or even an escrow account to hold money. BigTech firms are fiercely fighting in this arena, PayPal, Apple Pay, Samsung Pay, Amazon, Mastercard, and Visa are all in this business. In fact, banks also use master card and visa to offer their payment services; however, still the front is their name rather than actual technology providers.

4. Warehousing and clearing banking:

These are the activities that may be called “High Finance”. These sits at the top of the financial system and world economy and they provide the ability to settle all transaction in the domestic and global financial system. SWIFT technology and Bank of International Settlement are the pivots around which this works. Although, bitcoin and other crypto tried to become a threat; nevertheless, the fortress is too strong to break in.

5. Data Banking:

These activities are the now a hotly contested area in our modern society where the financial world is fighting hard to capture as much data as possible about customers. Their shopping attitude, their consumption behaviour, their saving behaviour, and their travel, leisure and pleasure behaviour. These data points are then used by banks and other fintech (which access them through open banking) to tailor products and services for their customers.

Conclusion

The above discussion establishes that FinTech or TechFin either complement existing banks or competes in some special aspects of banking activities. The real question is that making claims such as Banks can be replaced or eliminated altogether is a far cry. What may happen that these FinTech or TechFin eventually either become banks or may either be taken over by banks. We do not know, but in the next article I will explain that why banks are difficult to replace.

References:

- Hill, J. (2018). Fintech and the remaking of financial institutions. Academic Press.

- Nicoletti, B., Nicoletti, W., & Weis, A. (2017). Future of FinTech.

- Rubini, A. (2018). Fintech in a flash: financial technology made easy. Walter de Gruyter GmbH & Co KG.

- Chishti, S., & Barberis, J. (2016). The Fintech book: The financial technology handbook for investors, entrepreneurs and visionaries. John Wiley & Sons.

- VanderLinden, S. L., Millie, S. M., Anderson, N., & Chishti, S. (2018). The insurtech book: The insurance technology handbook for investors, entrepreneurs and fintech visionaries. John Wiley & Sons.

- Boot, A., Hoffmann, P., Laeven, L., & Ratnovski, L. (2021). Fintech: what’s old, what’s new?. Journal of financial stability, 53, 100836.

- Boot, A., Hoffmann, P., Laeven, L., & Ratnovski, L. (2020). What is Really New in Fintech. IMF Blog, December, 17, 2020.

- Timonen, K. (2022). The impact of fintech on the banking industry.

- Campanella, F., Serino, L., Battisti, E., Giakoumelou, A., & Karasamani, I. (2023). FinTech in the financial system: Towards a capital-intensive and high competence human capital reality?. Journal of Business Research, 155, 113376.

- Molnár, J. (2018). What does financial intermediation theory tell us about fintechs?. Vezetéstudomány-Budapest Management Review, 49(5), 38-46.

- Omarini, A. (2017). The digital transformation in banking and the role of FinTechs in the new financial intermediation scenario.